10 drugs that are likely targets for fall Medicare price negotiations

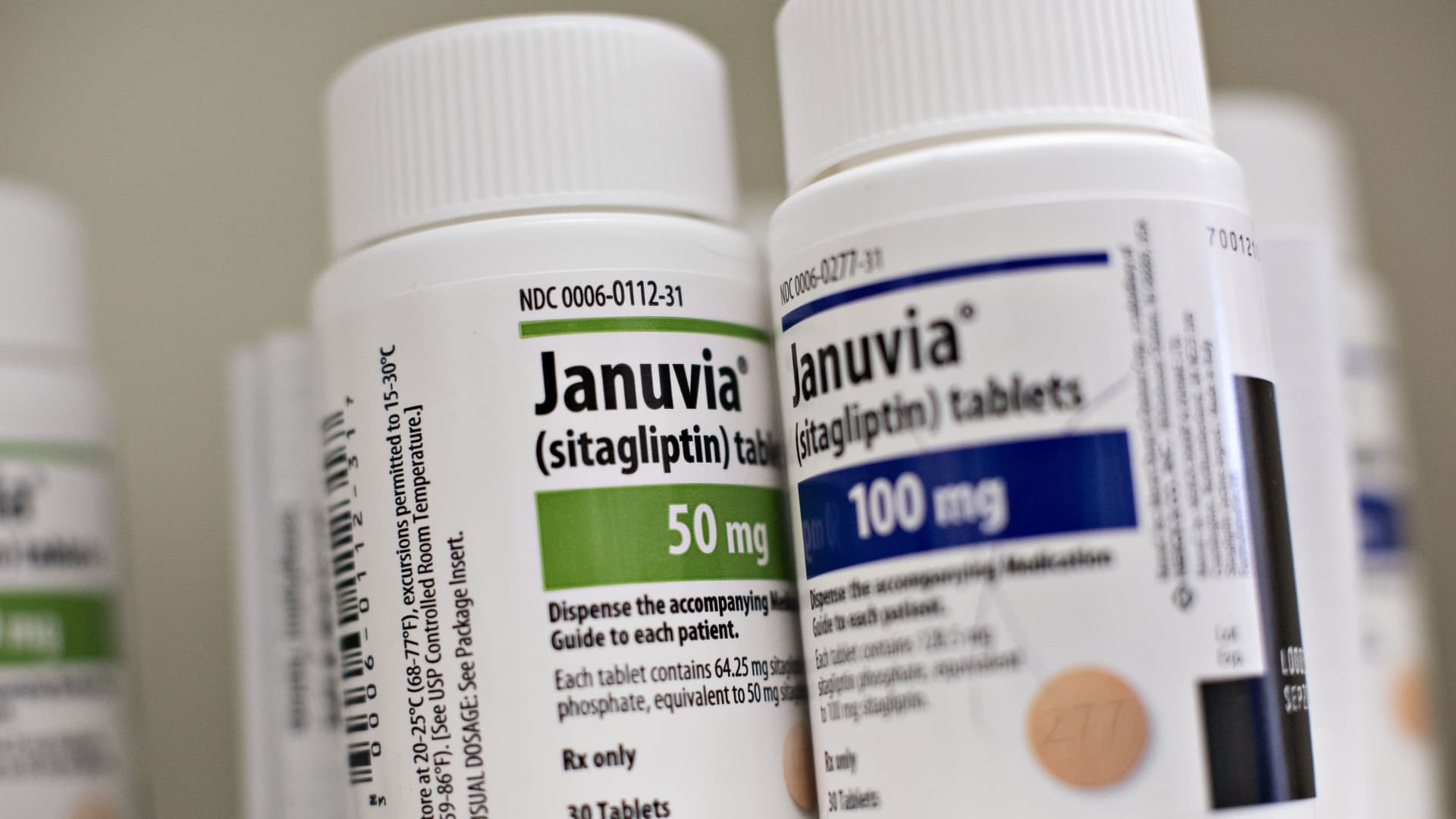

Merck & Co. Inc.’s Januvia brand medication, used to treat Type 2 diabetes.

Daniel Acker | Bloomberg | Getty Images

Medicare is poised to directly negotiate drug prices with the pharmaceutical industry this fall for the first time in the program’s nearly six-decade history.

The Centers for Medicare and Medicaid Services will unveil, no later than Sept. 1, the list of 10 drugs that it is targeting this year, an agency spokesperson said.

Though it is still unclear which 10 drugs Medicare will select, several pharmaceutical companies have already revealed in court filings that they expect four of their blockbuster medications to be targeted.

Merck‘s lawyers said the company’s Type 2 diabetes drug Januvia will be on the list, with its blockbuster cancer immune therapy treatment Keytruda to become a target in subsequent years.

Bristol-Myers Squibb and Johnson & Johnson, in separate filings, said their blood thinners Eliquis and Xarelto will be subject to the negotiations this year. Abbvie said in its own filing that the company expects its blood cancer drug Imbruvica will also be a target in the fall.

These are the other six drugs that will likely be subject to negotiations this year, according to an analysis by the Journal of Managed Care and Specialty Pharmacy published in March:

- Jardiance, made by Boehringer Ingelheim, used to treat heart failure

- Enbrel, made by Amgen, used to treat rheumatoid arthritis

- Symbicort, made by AstraZeneca, used to treat asthma

- Ibrance, made by Pfizer, used to treat breast cancer

- Xtandi, made by Astellas Pharma, used to treat prostate cancer

- Breo Ellipta, made by GSK, used to manage pulmonary disease

Surge in list prices

The historic negotiations, established by the Inflation Reduction Act, are the cornerstone of the Biden administration’s efforts to slash drug costs.

The list price of Medicare’s top 25 drugs has more than tripled on average since they first entered the U.S. market, greatly exceeding the rate of inflation, according to an analysis published by AARP on Thursday.

AARP is a powerful lobbying group that advocates on behalf of people ages 50 and older. The group strongly supports the Medicare drug-price negotiation program.

The list price of Januvia has surged 275% since 2006, according to the AARP. Eliquis has jumped 124% since 2012. Xarelto has increased 168% since 2011, and Imbruvica has risen 108% since 2013.

These price hikes were all significantly higher than the corresponding rate of inflation, which ranged from 31% in the case of Eliquis to 50% in the case of Januvia, according to AARP.

Merck booked $2.8 billion in revenue from Januvia in 2022. Bristol Myers Squibb generated $11.8 billion in sales from Eliquis last year. Johnson & Johnson reported $2.47 billion in revenue from Xarelto. And Abbvie posted $4.6 billion in sales of Imbruvica.

People enrolled in Medicare take an average of four to five prescription drugs a month and increasingly face out-of-pocket costs that many struggle to afford, according to AARP.

“More and more people face cost-sharing that is directly affected by drug price increases,” Leigh Purvis, who analyzes health-care costs for AARP, told reporters on a call Thursday.

One in 5 older adults cope with high drug prices by not filling a prescription or by skipping a dose to save money, according to a study published in Jama Network Open in May.

Industry aims to block negotiations

The pharmaceutical industry has filed a torrent of lawsuits to block the negotiations, arguing that the program is an unconstitutional seizure of their property. Drugmakers view the negotiations as a major threat to their profits and argue it will jeopardize future drug development.

Bristol Myers Squibb, Johnson & Johnson, Merck, the U.S. Chamber of Commerce, and the lobby group Pharmaceutical Research and Manufacturers of America have all sued in separate federal district courts.

Legal experts say the companies are spreading their lawsuits across the country to increase the chances that one of the cases will ultimately end up before the Supreme Court.

While the list of 10 drugs will be published by September, there’s growing uncertainty over whether the negotiations will move forward on schedule.

The U.S. Chamber of Commerce has asked a federal judge in Ohio to block the program before Oct. 1. Kelly Bagby, vice president of AARP’s legal team, said the chamber faces a heavy lift to convince the judge that its interests outweigh those of Medicare beneficiaries.

“It’s so obvious that the pharmaceutical companies are not the victims that they are painting themselves to be,” Bagby said on Thursday’s call.

“We are trying to protect the integrity of the Medicare program for everybody,” she said. “But we are also trying to allow for older people and vulnerable people to not have to make horrible choices — do I get to pay my rent today or do I get to take my lifesaving drugs.”

After the list of drugs is published, the manufacturers have to sign agreements to participate in the negotiations by Oct. 1. CMS will then make an initial price offer to the companies in February 2024. The manufacturers then have a month to make a counteroffer.

The negotiations end in August 2024, with prices published the following month. The reduced prices go into effect in January 2026.

No Byline Policy

Editorial Guidelines

Corrections Policy

Source