Trulieve Cannabis Q1: Another Weak Quarter Provides Opportunity (OTCMKTS:TCNNF)

Rex_Wholster

By all accounts, Trulieve Cannabis Corp. (OTCQX:TCNNF) didn’t report a very good March quarter. The cannabis multi-state operator (“MSO”) is now struggling to maintain market share due to the strong margins previously generated from a now competitive Florida market. My investment thesis remains Bullish on the MSO stock due to the cheap valuation and the ultimate opportunity via future adult-use sales in the Sunshine state.

Another Missed Quarter

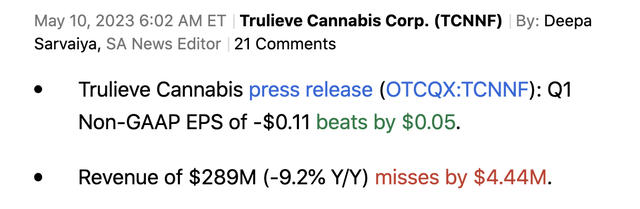

Trulieve Cannabis reported Q1’23 results that missed analyst estimates based on the following numbers:

Source: Seeking Alpha

The company has seen sales stall over the last couple of years. The Florida dispensary focus helped the MSO generate premium margins in the beginning, but Trulieve now faces a rough retail environment where quarterly sales have dipped from $320 million in Q2 ’22 to only $289 million now. The company has missed analyst revenue targets in 5 out of the last 6 quarters.

Trulieve reported an adjusted EBITDA profit of $78 million, but the amount collapsed from $105 million in the prior Q1 period. The MSO had solid adjusted EIBTDA margins of 33% last year, and the company has recently had to cut 20% of operating expenses in order to just achieve the 27% margin in Q1’23.

In total, Trulieve cut SG&A expenses by $24 million to only $102 million in Q1. The business got so difficult that Trulieve saw the adjusted EBITDA margins dip 600 basis points while cutting operating expenses by 20%.

At one point, the MSO was producing adjusted EBITDA margins in the mid-40% range. Trulieve Cannabis Corp. stock once traded above $50 when business was booming in Florida.

Florida Curse

Trulieve once saw operations focused on one state as a huge benefit due to concentrated sales leading to lower overall overhead costs. The warning all along was that Florida had limited licenses, but the state didn’t have store limits.

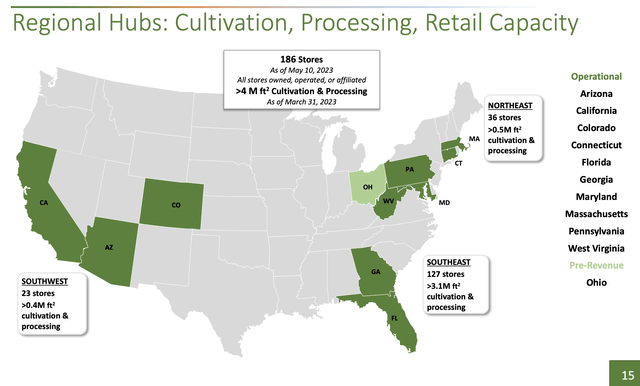

The MSO lists 186 retail stores now and over 4 million square feet of production capacity with up to 75% of those assets in Florida. The company has 125 stores and over 3 million square feet of production capacity in the Sunshine state.

Source: Trulieve Cannabis Q1’23 presentation

The whole Northeast operation only has 36 stores with operations in Ohio, Pennsylvania, Connecticut, Massachusetts, Maryland and West Virginia. Trulieve Cannabis only averages 6 stores per state in this secondary region, though Ohio won’t open their first medical cannabis stores until this quarter.

The MSO forecasts adding another 15 to 20 dispensaries in 2023, but the key is only the stores outside of Florida. Though, the major catalyst to the investment thesis could be the adult-use ballot initiative for November 2024.

Trulieve lists still having a 40% market share in Florida, and the company goes along with a forecast for the legal cannabis market reaching $6 billion in sales. The MSO only targets $1.2 billion in annual sales here and a 40% market share of a $6 billion market amounts to $2.4 billion worth of sales while a 30% market share would amount nearly $2 billion in sales, or nearly double the current revenue rate.

The stock has a market valuation in the $1.0 billion range with a diluted share count at ~192 million. The company has somehow ended up with a large net debt position of $451 million, placing the enterprise value at ~$1.5 billion.

While the Florida position was a problem a few years back, the stock is more appealing now that the outsized profits have disappeared. Trulieve is no longer valued based on those elevated margins and the stock hardly trades above 1x sales targets now.

The MSO forecast producing up to $100 million in operating cash flows this year, with only around $83 million spent on capex after just spending $14 million in Q1. The cash position should improve, especially as the competitive threats in the sector should lesson with most smaller companies lacking the capital to invest in the cannabis space.

Takeaway

The key investor takeaway is that Trulieve Cannabis Corp. is just far too cheap with an EV of $1.5 billion. The company has the sales and adjusted EBITDA to warrant a vastly higher stock price. The Florida operations curse could finally turn into an opportunity for sales growth with adult-use sales by 2025.

Investors should use the ongoing weakness in the cannabis space to snap up leading MSOs like Trulieve Cannabis Corp.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No Byline Policy

Editorial Guidelines

Corrections Policy

Source