Intra-Cellular Brightens MDD Outlook With Caplyta Success (NASDAQ:ITCI)

bgfoto/E+ via Getty Images

Intra-Cellular’s Caplyta Shows Promise in Major Depressive Disorder

In a November article, I wrote about Intra-Cellular’s (NASDAQ:ITCI) Caplyta (lumateperone), a drug approved to treat schizophrenia and bipolar depression. The article was particularly focused on the drug’s potential for Major Depressive Disorder (MDD). I had high expectations for important Phase 3 readouts.

(…) lumateperone’s innovative pharmacological profile, its potential to meet the unmet needs of MDD patients, its strategic use as an adjunctive therapy, along with its proven market success in other mental health conditions, form a logical and compelling argument for its likely success in treating MDD.

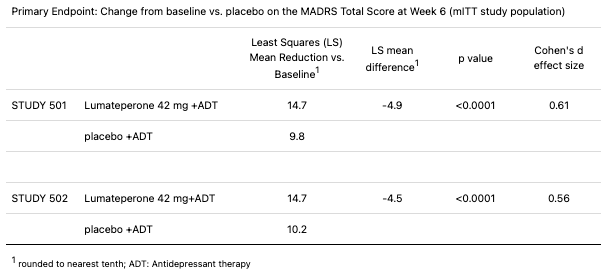

The company announced yesterday that two Phase 3 clinical trials evaluating lumateperone as an adjunctive treatment to antidepressants in MDD patients were successful.

Intra-Cellular

The data is clearly sparkling, and although the MDD market is saturated with many treatments, lumateperone is differentiated due to its unique pharmacologic profile targeting serotonin, dopamine, and glutamate pathways.

Johnson & Johnson’s (JNJ) Spravato (esketamine), for example, was in the news in 2019 after receiving FDA approval for the treatment of treatment-resistant depression, which is a very similar patient population that lumateperone will likely attend to. Despite its restricted access (REMS), classification as a Schedule III controlled substance, and boxed warning for sedation, dissociation, and abuse, Spravato is expected to eclipse $1 billion in revenue this year. A few antipsychotics, like Abilify, Rexulti, and Seroquel, have also added depression to their labels, boosting their revenues.

With indications like bipolar depression and schizophrenia under its belt, Caplyta is already nearing blockbuster status, with Intra-Cellular projecting between $645 and $675 million in revenue for 2024. The addition of an MDD label would significantly expand the drug’s market. I believe peak annual revenue estimates in excess of $3 billion are now within reach. Intra-Cellular shifts to regulatory matters, with a sNDA planned for later this year.

It’s important to note that lumateperone’s composition-of-matter patent expires in December 2028. This may open it up to generic competition. Intra-Cellular has a variety of method patents that may help extend its exclusivity. Moreover, Intra-Cellular’s development of a long-acting injectable formulation of lumateperone (in Phase 1) may be particularly attractive for bipolar and schizophrenic patients due to low treatment adherence in these populations.

Q1 Earnings

Caplyta sales totaled $144.843 million in the three months ended March 31, up 53% from the same period the previous year. SG&A expenses increased from $98.9 million in Q1 2023 to $113 million. R&D expenses increased modestly to $42.8 million. The net loss for the first quarter was $15.247 million, which was less than the $44 million net loss in Q1 2023. The weighted average number of common shares remained relatively unchanged.

Financial Health

As of March 31, Intra-Cellular’s cash and cash equivalents were $139.819 million. Investment securities totaled $335.8 million. Total current assets outweigh total current liabilities ($690.527 million/$134.8 million). Net cash used in operating activities for Q1 was $34.116 million. If we divide their most liquid assets (cash and securities) by their quarterly cash burn, this implies a cash runway into 2027. However, this estimate is based on historical figures and does not account for future changes in revenue and/or expenses.

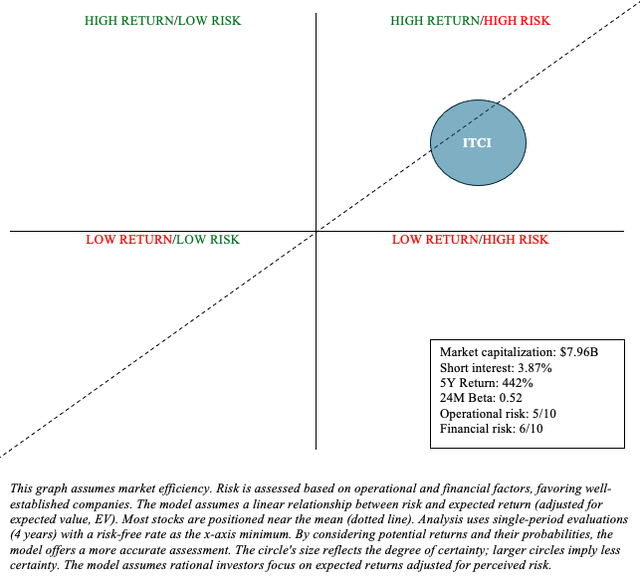

Risk/Reward Analysis and Investment Recommendation

Intra-Cellular is approaching breakeven with Caplyta, and the recent MDD data and expected launch in the second half of 2025 should boost revenue prospects. Because of its unique mechanism of action, efficacy, and safety profiles, I believe lumateperone will perform admirably as an adjunct treatment for MDD. Subsequently, it’s reasonable to believe that the drug can achieve over $3 billion in peak annual revenue.

In terms of reward, ITCI’s market capitalization of approximately $8 billion appears to adequately price in the opportunity in schizophrenia, bipolar depression, and MDD. So I am not sure how much upside remains outside of M&A activity (which I believe Intra-Cellular is a good candidate for). In terms of risk, an MDD market launch is expected to be expensive, and Intra-Cellular’s cash reserves are modest. So it remains to be seen whether Caplyta can bring them into profitability before their cash runs uncomfortably low. Furthermore, ITCI will likely face an overhang as lumateperone’s COM patent expires in 2028. As a result, ITCI may not trade at its full potential.

Author

To summarize, ITCI is a Quadrant 1 stock. That is, there is a high return potential, but it comes at a high risk. As such, it may be appropriate for a barbell portfolio (“Buy”), in which an investor allocates 90% of funds to low-risk assets such as Treasuries and broad market ETFs, while the remaining 10% is allocated to higher-risk stocks such as ITCI. Lumateperone is an excellent addition to mental health treatment, but it is unclear how long ITCI will be able to benefit from it. For the time being, I am of the opinion that we should “roll with the momentum until something tells us otherwise.”

No Byline Policy

Editorial Guidelines

Corrections Policy

Source