ARS Pharmaceuticals Stock: A Decent Bet For Upside After Neffy Approval (NASDAQ:SPRY)

vgajic/E+ via Getty Images

Investment Overview

The San Diego based biotech ARS Pharmaceutical’s (NASDAQ:SPRY) share price is up nearly 120% year-to-date, and at the end of August, shares made a quick >20% gain, after its lead and only product, neffy, a nasal spray, was approved for commercial use by the FDA, ahead of schedule, for the treatment of Type I Allergic Reactions.

In its latest, Q2 2024 quarterly report / 10Q submission, ARS provides basic information around neffy as follows:

ARS-1 (brand name neffy) is a proprietary product candidate for the needle-free intranasal delivery of epinephrine (adrenaline) for the emergency treatment of Type I allergic reactions, including anaphylaxis.

neffy is a proprietary composition of epinephrine with an innovative absorption enhancer called Intravail®, which allows neffy to provide intranasal delivery of epinephrine.

We believe neffy’s “no needle, no injection” approach will address a significant unmet need in the use of epinephrine, which is currently approved only in injectable formulations for the emergency treatment of Type I allergic reactions.

The potential commercial opportunity is outlined as follows:

There are approximately 40 million people in the United States who experience Type I allergic reactions. Of this group, over the last three years, approximately 20 million people have been diagnosed and experienced severe Type I allergic reactions that may lead to anaphylaxis, but (in 2023, for example) only 3.2 million filled their active epinephrine autoinjector prescription, and of those, only half consistently carry their prescribed autoinjector with them due to the many drawbacks of these devices. In aggregate, we estimate that up to 90% of patients prescribed an epinephrine device are not achieving an optimal treatment outcome today.

ARS joined the Nasdaq via a reverse merger with failed drug developer Silverback Therapeutics in July 2022, and traded generally within a range of $4 – $8 until September 2023, when the FDA rejected neffy for approval at the first time of asking, in spite of the positive outcome of an Advisory Committee convened by the FDA, of its Pulmonary-Allergy Drugs Advisory Committee (“PADAC”). According to ARS:

At that meeting, on the question of whether the data from our neffy pharmacokinetic (“PK”)/pharmacodynamic (“PD”) results support a favorable benefit-risk assessment in adults for the emergency treatment of Type I allergic reactions including anaphylaxis, the PADAC voted 16 (yes) and 6 (no).

On the question of whether the neffy PK/PD results support a favorable benefit-risk assessment in children ≥30 kg for the emergency treatment of Type I allergic reactions including anaphylaxis, the PADAC voted 17 (yes) and 5 (no).

In its Complete Response Letter (“CRL”) (outlining reasons for rejection) The FDA requested a PK/PD study assessing repeat doses of neffy compared to repeat doses of epinephrine injection product under allergen-induced allergic rhinitis, and additional information on nitrosamine impurities.

ARS completed this study and submitted data to the FDA in April this year. The FDA set a decision date for October 2nd, but ultimately decided to approve neffy ahead of time. ARS’ share price, which had slipped <$3.5 after the initial rejection, hit highs of ~$15 on the news.

Commercial Opportunity Attractive

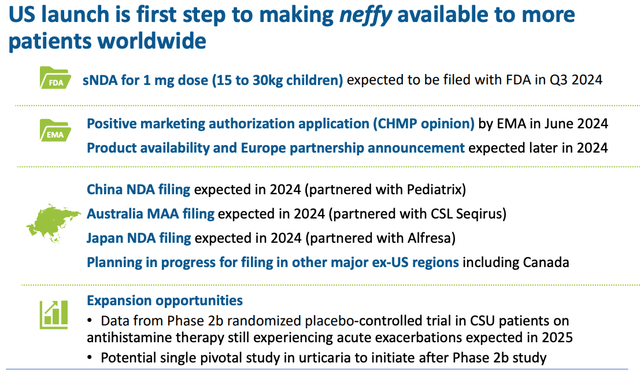

ARS nefy expansion opportunities (corporate presentation)

As we can see from this slide above taken from ARS’ approval presentation, management has plans to secure approval for a pediatric label, and will launch in Europe, presumably with a partner – an announcement is due this year. China, Japan, and Australia could be next.

William Blair analysts have speculated peak revenues of ~$750m per annum for neffy, or potentially higher if neffy can win label expansions in fields such as urticaria (“hives”).

The main competition in the allergy indication at present is Viatris’ epi-pen injector, which earned revenues of $442m in 2023, and $378m in 2022, although Aquestive Therapeutics (AQST) has a buccal film version of epinephrine which could be approved next year.

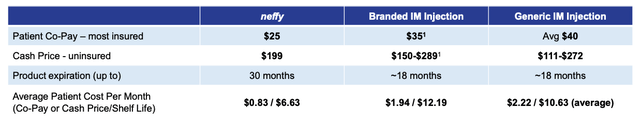

Commercially speaking, ARS has a sales force of >100 sales executives targeting ~12.5k allergy specialists, and the company has shared data suggesting neffy will be a cheaper option than auto-injectors, as below:

neffy cost comparison (presentation)

I suspect the biggest challenge may be persuading the general public, physicians, and potentially insurers, that neffy is just as effective and safe as epi-pen or other auto-injectors.

ARS’ clinical data suggests that is the case – in its approval press release, the FDA notes that approval is:

based on four studies in 175 healthy adults, without anaphylaxis, that measured the epinephrine concentrations in the blood following administration of neffy or approved epinephrine injection products.

Results from these studies showed comparable epinephrine blood concentrations between neffy and approved epinephrine injection products. Neffy also demonstrated similar increases in blood pressure and heart rate as epinephrine injection products, two critical effects of epinephrine in the treatment of anaphylaxis.

A study of neffy in children weighing more than 66 pounds showed that epinephrine concentrations in children were similar to adults who received neffy.

There has been a considerable amount of hype around the approval of neffy, and analysts at Raymond James have set a price target of $22 for the stock.

The company reported $220m of cash as of Q2, and a net loss of just $(12m), however costs and expenses will ramp up considerably in support of a commercial launch, and analysts will be watching early sales figures closely and speculating about whether the drug may have “blockbuster” (>$1bn revenues per annum) potential.

If that early sales data is encouraging, I suspect we could see ARS’ share price make further substantial gains, so we are not necessarily at the peak of the bull run by any stretch, although entrenched competitors such as Viatris and Teva Pharmaceuticals may prove difficult to take market share away from, thanks to their superior commercial experience and potentially larger SG&A budgets.

The next test for ARS is a commercial one – it will be down to management – and Chief Commercial Officer Eric Karas, who formerly led commercial initiatives for NARCAN® Nasal Spray at Adapt Pharma, Inc., which was acquired by Emergent BioSolutions (EBS) in 2018 – to execute a strong launch campaign.

Valuation – A Little Over-Hyped, But Domestic Market Plus Expansion Opportunities Make Bull Case

As mentioned, the approval of neffy has been widely publicised, and it is not usually a good idea to invest in a company that is “trending” or over-hyped, however in the case of neffy, the benefits of the drug are quite clear, and the market opportunity quite compelling.

One member of the FDA’s advisory committee that voted strongly in favour of approving neffy backed up ARS’s assertion that prescriptions for injectors are written but not filled, suggesting that ~6m prescriptions are written every year in the US, and 40% not filled.

It’s hard to imagine that caregivers would not prefer a spray over a needle injector when acting in an already highly stressful situation – on the approval conference call with analysts, ARS’ President and CEO noted:

Due to its simplicity and effectiveness in the future, it may be possible for neffy to be available in public places for use in an allergy emergencies such as at restaurants or airplanes where this would not be possible with injection devices given the needle related risks. And finally, the neffy device is highly reliable in delivering an effective dose with less than one in a hundred-thousand chance of being outside of specifications for the dose delivered.

In order to demonstrate that neffy can tolerate high and low temperatures, we’ve completed stability studies at 122 degrees Fahrenheit for up to three months, as well as freeze-thaw studies that show that performance in neffy is robust, even under these conditions.

If we assume that ARS’ receives ~$150 for every neffy spray bottle sold (using the uninsured cash price as a guide, and subtracting ~$50 to account for rebates / discounts), then a 20m patient market such as the US supports a market opportunity of ~$3bn, but let’s be more realistic and say in its first full year on the market, 2025, neffy grabs 15% of the market share of those people currently filling prescriptions – 3.2m people.

That translates to ~$72m revenues in year 1, which may not sound like much for a company valued at $1bn market cap, but overheads are negligible – the company spent <$7m of R&D in Q2, and <$9m on G&A. You'd expect SG&A to ramp up significantly as the product hits the market, so let's double that figure, and multiply by four for the full-year - $72m, matching the revenue figure.

Now if we look at 2026 and assume all 6m patients with prescriptions written can be targeted, and 20% market share achieved, we are looking at revenues of ~$180m, and a full-year profit of close to $100m, for a forward price to earnings ratio of ~10x.

Finally, let’s factor in a European partner that pays ARS somewhere in the region of ~$150m per annum in milestones and sales-based royalties, and lastly, let’s add territories such as Australia, Japan, and perhaps even China – another $100m.

Within 3 years, I see a revenue opportunity of ~$450m, and let’s assume a margin of 55%, as we did for 2026, profits of >$250m, and therefore, a forward PE of <5x - a ratio that is typically associated with a "buy" opportunity.

Concluding Thoughts – Positives Seem To Clearly Outweigh Negatives – A Slightly Risky Buy Opportunity Is In Play

I would call ARS a “slightly risky” opportunity because there are several issues generally associated with smaller biotechs bringing products to market that may apply to ARS, although for each issue I am able to find a potential positive to counterbalance it.

For example, the company is not cash rich so cannot afford a major outlay on a marketing campaign, however the product’s strength has created a good deal of free media attention, meaning most prescribing physicians will likely be aware of neffy.

It’s possible another company could bring a nasal spray to market in the same indication although in its 2023 annual report, ARS, while name checking Hikma Pharmaceuticals, Inc. (previously INSYS Therapeutics, Inc.), Nasus Pharma, Orexo AB, Belhaven BioPharma and Amphastar Pharmaceuticals (AMPH) says:

We are not aware of any other company that has a “no needle, no injection” epinephrine product candidate in clinical development in the United States that has demonstrated PKs bracketed by the approved injection products for all PK parameters requested by the FDA.

neffy also has patent protections in place that may last until 2038. There is single asset risk to consider, as ARS has no other products to bring to market, but it does have multiple label expansions it could pursue, and new territories to target.

In my view, neffy ticks all the boxes for a product that can make a real difference in its target indication, but it is often the case that a good product can be buried beneath more established products owned by companies with bigger marketing budgets.

That would be my biggest concern for ARS, but ultimately, I believe the undeniable advantages of its product versus market incumbents is compelling enough to overcome these problems.

I am not sure neffy can become a “blockbuster” product in the US market alone, but I don’t think $500m per annum is necessarily out of reach, and that, coupled with approvals in larger overseas territories, which I would expect to occur within a couple of years, makes for a reasonably compelling “buy” case, in my view.

No Byline Policy

Editorial Guidelines

Corrections Policy

Source