Windlas Biotech’s Stock Faces Decline, But Shows Potential for Growth in Pharmaceutical Industry

Windlas Biotech, a smallcap pharmaceutical company, experienced a -7.59% decline in its stock price on November 4th, 2024, underperforming the sector by -6.25%. However, the company has shown a positive performance of 17.89% in the past month and is currently trading higher than its moving averages. With a focus on developing high-quality generic pharmaceutical products, Windlas Biotech has a strong presence in both domestic and international markets.

Get Detailed Stock Report

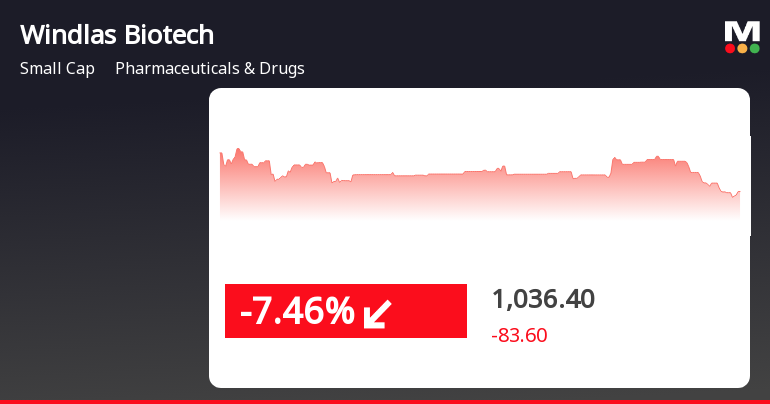

Windlas Biotech, a smallcap pharmaceutical company, has recently faced a decline in its stock price. On November 4th, 2024, the company’s stock fell by -7.59%, underperforming the sector by -6.25%. This trend reversal comes after four consecutive days of gains for the company’s stock.

The stock’s performance today has been lower than the Sensex, with a -7.46% decrease compared to the Sensex’s -1.58% performance. However, over the past month, Windlas Biotech has shown a positive performance of 17.89%, while the Sensex has seen a decline of -3.94%.

Despite the recent decline in stock price, MarketsMOJO has given a ‘Hold’ call for Windlas Biotech. The company is currently trading higher than its 5 day, 20 day, 50 day, 100 day, and 200 day moving averages, indicating a positive trend in the long term.

Windlas Biotech is a smallcap company in the pharmaceutical and drugs industry. It is focused on developing and manufacturing high-quality generic pharmaceutical products. The company has a strong presence in both domestic and international markets, with a commitment to providing affordable and accessible healthcare solutions.

While there has been no mention of investor interest or expert opinions, the company’s performance and market trends suggest a positive outlook for Windlas Biotech. As a smallcap company, it has shown resilience and potential for growth in the pharmaceutical industry.

No Byline Policy

Editorial Guidelines

Corrections Policy

Source