Downturn for top biopharma companies Q3 market cap as Covid-19 vaccine demand falls

The top 20 global biopharmaceutical companies exhibited a downward trend in aggregate market capitalisation by 9.1% from $3.45 trillion in Q2 2022 to $3.14 trillion in Q3, according to GlobalData’s Pharma Intelligence Center Companies Database. This downturn in market cap was attributed to a decline in the demand for Covid-19 vaccines and therapies. The growing competition from generic drugs presents challenges for the top 20 players placing pressure on drug prices.

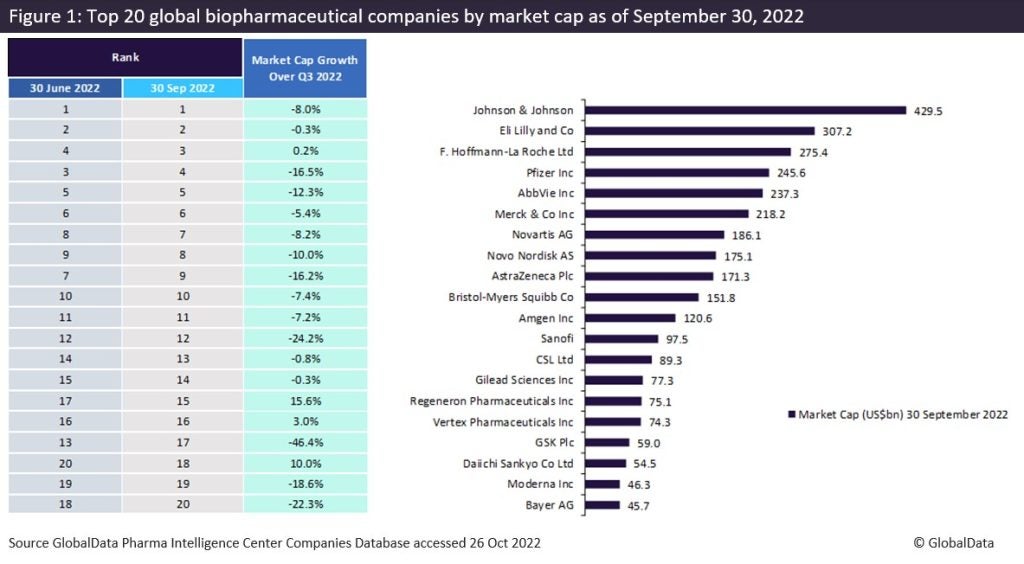

Out of the top 20 biopharmaceutical companies, 16 companies reported a drop in market capitalization, and eight companies saw a decline of more than 10%, as shown in Figure 1. However, Johnson & Johnson continued its dominance by maintaining its top position even after suffering a market capitalization loss of 8%. Eli Lilly was in second place, followed by Roche and Pfizer.

Eli Lilly saw strong global drug sales of $187m in Q3 for Mounjaro (tirzepatide), its new type 2 diabetes therapy, which was approved by the FDA in May 2022, according to GlobalData’s Drugs Database Pharma Intelligence Center. The FDA also awarded priority review for Eli Lilly’s donanemab, a monoclonal antibody for Alzheimer’s disease, in August 2022, and the company expects approval by February 2023. This is one in five therapies Eli Lilly intends to launch by the end of 2023, which could help it maintain its spot within the top biopharmaceutical companies.

Regeneron Pharmaceuticals, which is based in the US, and Daiichi Sankyo, which is based in Japan, witnessed the biggest growth in market capitalization over Q3 2022 with 15.6% and 10%, respectively. Despite a drop in sales from Regeneron’s COVID-19 antibody, REGEN-COV, due to ineffectiveness against the Omicron variant, the company experienced record US sales of $1.63 billion in Q3 from its blockbuster drug Eylea (aflibercept) for neovascular (wet) age-related macular degeneration (AMD), macular edema following retinal vein occlusion (RVO), diabetic macular edema (DME) and diabetic retinopathy (DR) according to GlobalData’s Drugs Database. Daiichi Sankyo experienced boosted sales with its partner AstraZeneca for their cancer drug, Enhertu (fam-trastuzumab deruxtecan-nxki) after receiving FDA approval in Q3 for human epidermal growth factor receptor 2 (HER2)-low metastatic breast cancer and HER2-mutant metastatic non-small lung cancer. Vertex is another biopharmaceutical company in the top 20 list that indicated upward trajectory in Q3 2022 by recording 3% market capitalization growth due to its franchise of therapies to treat cystic fibrosis

GSK and Sanofi’s share prices dropped sharply by 46.4% and 24.2%, respectively, due to the increasing number of Zantac cancer lawsuits. GSK moved four places down the top 20 list to 17th place. However, the company is anticipated to experience recovery as it awaits regulatory approval from the FDA, expected in May 2023, after receiving priority review for its respiratory syncytial virus (RSV) vaccine.

Bayer recorded a negative market capitalization growth of 22.3% in Q3 due to its announcement regarding a $706m provision for the environmental damage caused by some legacy Monsanto chemicals. Moderna’s market capitalization dropped by 18.6%, with Pfizer and AstraZeneca reporting drops of 16.5% and 16.2%, respectively, over Q3 as concerns that sales of their Covid-19 vaccines may start to decline soon. Other major players that indicated negative market capitalization growth of more than 10% include AbbVie (-12.3%) and Novo Nordisk (-10%).

Although AbbVie’s Humira (adalimumab) is set to face biosimilar competition next year, the blockbuster drug reported strong US sales of $4.96 billion for Q3, according to GlobalData’s Drugs Database. The company is expected to continue experiencing positive growth from its new immunology drugs, Skyrizi (risankizumab-rzaa) and Rinvoq (upadacitinib).

The declining demand for Covid-19 therapies, growing generic drug competition placing pressure on drug prices, and high inflation are some key areas impacting biopharmaceutical companies going into 2023. The slowdown in merger and acquisition deals in 2022 and drug portfolio optimization from companies divesting their assets could indicate that the top biopharmaceutical companies will seek a streamlined, more focused approach to their innovator drug pipelines next year.

No Byline Policy

Editorial Guidelines

Corrections Policy

Source