Here’s Why Walgreens Stock (NASDAQ:WBA) Fell to a 52-Week Low on Friday

Shares of Walgreens Boots Alliance (NASDAQ:WBA) fell to a fresh 52-week low on September 1 following the announcement of its CEO, Rosalind Brewer’s, departure. The company even announced that it expects Fiscal year 2023 earnings to come in at the lower end of its guidance range. As a result, WBA stock fell 7.4% to close at $23.43 on Friday.

The international healthcare corporation runs retail pharmacy chains, named Walgreens in the United States and Boots in the United Kingdom. Brewer stepped down from her role as CEO and Board member, effective August 31, on amicable terms. However, Walgreens said Brewer will assist in finding a suitable replacement, someone with “deep health care experience,” and aid in the smooth transition. Meanwhile, lead independent Director Ginger Graham will act as interim CEO. The news sent WBA stock trickling down to lows not seen since 1999.

In June, Walgreens lowered its full-year earnings guidance to fall between $4.00 and $4.05 per share. The pharmacy chain cited “challenging consumer and macroeconomic conditions, and lower COVID-19 vaccine and testing volumes” as reasons for the slump in performance. Concurrently, Walgreens Boots also announced that it will be shutting down 300 stores in the U.K. and 150 across the U.S. in the coming year.

What is the Future of WBA Stock?

WBA stock has been under pressure in 2023 owing to a tough macro backdrop and internal challenges as it pivots to becoming a healthcare company. Year-to-date, WBA stock has lost 34%. The decline in WBA’s stock price during the year has prompted the stock to lose its place in the S&P 100 index. Industrial goods manufacturer Deere (NYSE:DE) will replace WBA stock in the index, effective September 18.

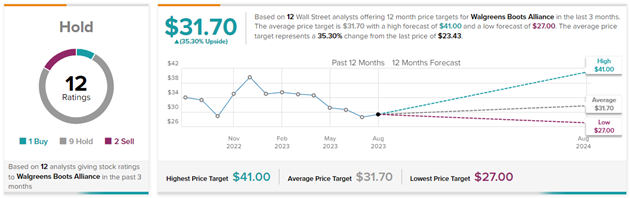

With these challenges in hindsight, Wall Street also prefers to remain on the sidelines. On TipRanks, Walgreens Boots stock has a Hold consensus rating based on one Buy, nine Holds, and two Sell ratings. The average Walgreens Boots Alliance price target of $31.70 implies 35.3% upside potential from current levels.

Disclosure

No Byline Policy

Editorial Guidelines

Corrections Policy

Source