Inflation Reduction Act: Pharma Companies in Hot Water?

President Biden signed off on the Inflation Reduction Act (IRA) on August 16, 2022. It is a broad package that not only aims to reduce the cost of prescription drugs, and thus overall health care spending on drugs for the federal government, but also has climate change-related provisions, increased taxation on high-income earners and corporations (which will also impact many pharma companies but not discussed in this note) and create ‘better paid’ jobs for Americans.

In 2020, U.S. health spending soared by 9.7 percent to $4.1 trillion, or $12,530 per capita. Compared to 2019, the growth rate was significantly higher; however, much of the growth in government spending is attributable to combatting the extraordinary COVID-19 epidemic.

IRA impact on healthcare spending

The IRA is meant to help lower the cost of prescription drugs. It will ensure that Medicare recipients are supported with catastrophic drug costs by phasing in a cap for out-of-pocket expenses at $2000 by 2025. It has also set a $35 cap for a month’s supply of insulin.

For the first time, Medicare will now be able to negotiate prices for certain high-cost drugs, and pharma companies will also have to give rebates to Medicare if they increase their prices more than inflation. The Act also has extended health insurance premium subsidies for union members or family members who benefit from the Affordable Care Act.

Read more: Contract Manufacturing Policy for Pharmaceuticals gets Government approval

Implementation of the Prescription Drug Provisions in IRA

For the last several years, Congress has been under pressure from increasing numbers of constituents saying they could not afford insulin – a life-saving drug. By 209, several states had already introduced caps on co-payments. According to 2017 data from the Health Care Cost Institute, insulin prices nearly doubled from 2012 to 2016, with the average price for a 40-day supply increasing from $344 to $666. According to figures from Kaiser Family Foundation, out-of-pocket spending by Medicare beneficiaries for insulin products has increased from $236m to $1.03b between 2007 to 2020.

Under the IRA, beginning in 2023, Medicare Part D prescription drug beneficiaries cannot be charged a co-pay of more than $35 for a one-month supply of insulin. Furthermore, for Medicare Part D, plans cannot charge more than $35 for whatever insulin products they cover by 2023 and 2024. By 2025, all insulin products will fall under the cap.

Sanofi SA (SASY.PA), Eli Lilly and Co (LLY.N), and Novo Nordisk(NOVOb.CO) are the three major companies dominating the Insulin products markets in the USA.

Read more: New antibody therapies generating huge interest from investors

Price controls of selected drugs

Over time Medicare has offered larger numbers of covered prescription drugs, which has impacted its budget. IRA will allow the federal government to levy price controls on these single-source drugs to get low prices for an increasing number of drugs covered by Medicare. A large part of the Federal government’s Medicare Part D (retail prescription drugs) and Part B (physicians administered) spending is concentrated among a small number of expensive drugs, mainly those that do not have generics or do not have similar competitor’s offerings.

Analysis by KFF shows that 250 prescription drugs (from a sole source and with no generics or biosimilar competitors) accounted for 60 percent of Medicare Part D drug spending, and the top 50 drugs accounted for 80 percent of Part B drug spending in 2019. Their analysis shows that the top ten drugs include three cancer medications, four diabetes medications, two anticoagulants, and one rheumatoid arthritis treatment.

Under IRA, in 2026, price control can be levied on 10 Part D drugs, and by 2027 it has allowed price controls on 15 Part D drugs, 15 Part B and Part D drugs in 2028, and this will rise to 20 Part B and Part D drugs by 2029 onwards. While the exact details of price control are currently not in the public sphere, it seems that the government can price the drugs at its will, and some elements of monopsony may play out.

The specific drugs chosen will be published as per the Act on February 1st, two years before its initial price applicability year. So, in the case of the ten drugs chosen for 2026, we will find out on February 1st, 2024. The Act states these will be ranked and selected as per the highest total expenditure in the 12 months before October 31st in the year before the selected drug publication date, i.e., October 2023 in the first round of price controls.

Read more: Pakistan running out of life saving drugs

Inflation rebate provision

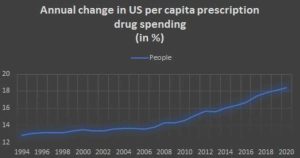

The second general provision under IRA entails drug manufacturers to pay rebates to Medicare if they increase prices faster than inflation for drugs used by Medicare beneficiaries. As an illustration, in 2019, when inflation was around 1 percent, prescription drug prices saw price rises of 7.5 percent. Analysis done by KKF based on the most recent drug spending data released by the Centers for Medicare & Medicaid Services (CMS) showed that between 2019 and 2020, half of all drugs covered by Medicare had significant price increases above the inflation rate. Under the IRA, 2021 will be used as the base year for prices for the inflation-related price increases used in the inflation rebate provisions after its introduction in 2023.

Potential Implications of IRA

The US is a global leader across the world when it comes to spending on R&D in health/pharmaceutical research. A key component of this has traditionally been the open competitive markets with no price controls, unlike many other parts of the world that have encouraged innovation in the field. Price controls on prescription drugs will harm potential future innovation in the field. There is a danger that, at the micro level, it will very likely impact the type of drug research being conducted.

While the IRA will exempt newer medicines from price controls, the number of years a drug is classified as ‘new’ varies across categories.

So, for example, price controls for ‘small-molecule’ drugs may begin nine years after Food and Drug Administration (FDA) approval, yet price controls for ‘biologicals’ (drugs made from living cells such as xxx) could start 13 years after approval. This difference in four years may change the profit incentive structure for pharma companies and hence the subsequent implications on the type of R&D undertaken. This is especially true for pharmaceutical companies like Insilico Medicine, AbbVie, Amgen, Atomwise and EQRx, etc., dealing with small molecule drugs segment (i.e., manufacturing of aspirin, diphenhydramine, and other “medicine cabinet” drugs).

Read more: Pharma company denies hoarding 48m Panadol tablets after raid

The anticipated revenue from a new drug, the anticipated development costs, and laws that affect drug supply and demand all have a role in determining how much money pharmaceutical companies invest in research and development. R&D spending in the pharmaceutical industry includes a wide range of activities, including invention, or the research and development of new drugs; development or clinical testing; preparation and submission of applications for FDA approval; and design of production processes for new drugs; incremental innovation, including the development of new dosages and delivery mechanisms for existing drugs and the testing of those drugs for additional indications; product differentiation, or the clinical testing of new drugs; and, finally, product differentiation, or the design of new drugs.

Government-imposed pricing limitations in the biggest market in the world would unquestionably substantially hinder investment. According to economists Joseph Golec and John Vernon estimate, from 1986 to 2004, the United States would have created 117 fewer new medication compounds for the globe if it had implemented European-style pricing regulations on pharmaceuticals.

Potential companies affected

Market analysts speculate that potential drugs for price control include Bristol Myers Squibb and Pfizer’s Eliquis, Eli Lilly’s diabetes meds Trulicity and Jardiance, AbbVie and Johnson & Johnson’s Imbruvica, plus Gilead Sciences’ HIV therapy Biktarvy. BMS’ Revlimid, AbbVie and J&J’s Imbruvica, and Pfizer’s Ibrance and Xtandi. Generally, pharma companies with more U.S.-focused operations are expected to have a higher risk, such as Amgen, AbbVie, and Gilead, those with lower exposure include Novartis, Sanofi, and AstraZeneca, including companies that are more diversified businesses outside their pharma units.

According to an analysis done by PwC (PricewaterhouseCoopers), companies could re-strategize their plans. The easiest would be to increase the initial launch price of any new drug on the market. But there is also a likelihood that they would remove existing schemes, co-pay and patient assistance programs, and reduce discounts in commercial markets.

No Byline Policy

Editorial Guidelines

Corrections Policy

Source