Pharmaceutical Cannabis Industry Sales to Grow 20% to $1.37bn by 2027, According to New Report

Pharmaceutical cannabis industry sales are expected to grow by over 20% over the next four years, from $1.14b to $1.37b by 2027.

However, according to Prohibition Partners’ upcoming Pharmaceutical Cannabis report, which Business of Cannabis was given access to ahead of its August release, the current market is still dominated by a single key player.

Jazz Pharmaceuticals, which owns the IP for market-leading Epidiolex, currently holds an estimated 76% share of the overall market.

However, with a growing number of clinical trials in the works for new cannabis compounds and for new conditions, alongside the expected expiry of Jazz Pharma’s patents, the market could soon be set to open up.

Deep Pockets

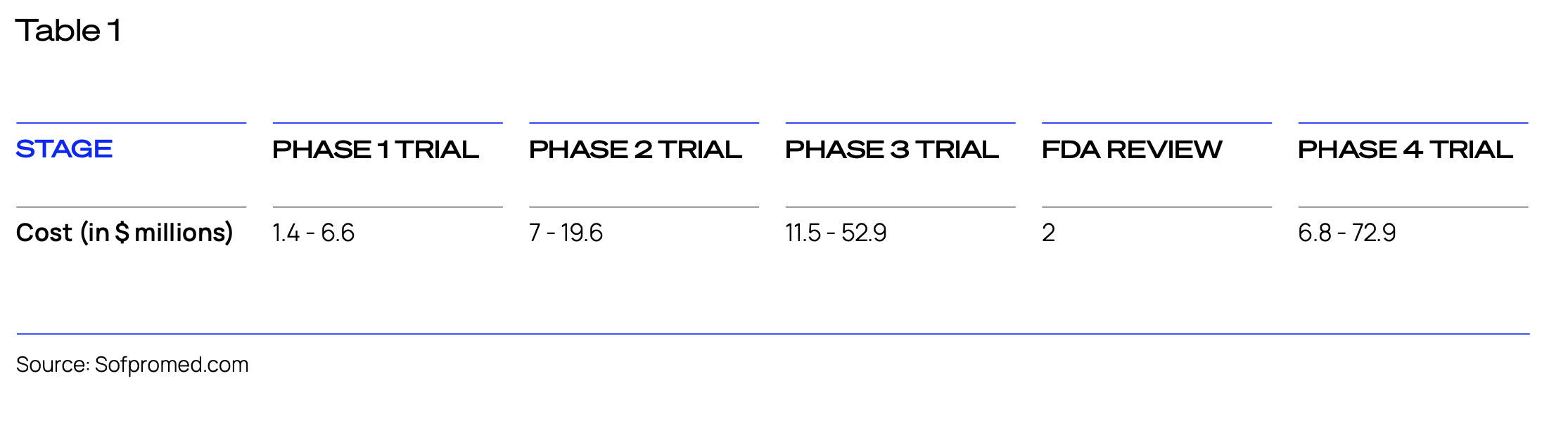

As the report lays out in detail, the staggering costs associated with bringing a medicine through all clinical trial stages before it can get approval from authorities to be fully commercialised remain a huge barrier for market entrants.

Establishing IP and navigating the stringent procedures and standards involved in bringing a new medical cannabis product to market require ‘enormous’ time and financial resources, meaning only specialised pharmaceutical companies have the expertise and available cash to succeed.

As shown above, the costs associated with bringing a product through all four trial stages and bringing it to market will cost at least $20m, providing each trial is successful the first time.

This potential for failure means a return on investment is not guaranteed, and only companies with a robust enough balance sheet to absorb the costs are likely to take the risk.

Other than cost, companies are also often held back from researching new cannabis treatments due to the difficulty in patenting medicines which come directly from plant material.

The report suggests that there will ‘undoubtedly be a larger place for the medical application of cannabinoids in the mainstream of medicine’ in the near future, with momentum continuing to build in R&D cannabis projects across the globe.

Furthermore, the landscape of clinical trials involving cannabinoids has witnessed significant advancements in recent years, moving from a focus on chronic pain, neuropathic pain and MS to encompass a far wider range of disorders.

The number of countries carrying out clinical trials has also greatly expanded, largely driven by the growing legalisation of medical cannabis in places such as Israel, Canada, some states in the US and many European countries, which ‘has facilitated the expansion of clinical research’.

Patent Monopoly

Jazz Pharma, alongside another handful of key players, also dominates patenting activity in the pharmaceutical cannabis industry.

Following its landmark $7.2b acquisition of GW Pharma and GW Research, Jazz Pharma owns the vast majority of the value in IP related to the medical application of cannabinoids.

GW’s collective portfolio consists of a total of at least 396 patent families, containing 1,824 individual patents across 37 national and international patent registry offices, a number which has continued to grow rapidly.

For context, the limited number of other cannabis-focused companies with sizeable portfolios, including Canopy Growth and Hexo Corporation (now owned by Tilray), still have a total patent count of less than half of GW’s, with the patents focusing primarily on non-medical products.

At the start of 2023, media reports emerged that Jazz Pharma had filed lawsuits against 13 competitors which it said were positioning themselves to begin producing generic versions of Epidiolex, which generates the company $800m a year.

While the exact date of expiry in the US for the company’s exclusivity for the sale of Epidiolex is not certain, some sources suggest that generic versions could make their way onto the market by 2026.

This is also thought to be the case for Sativex, with Jazz’s exclusivity expected to end within a similar time frame, which could lead to a significantly increased uptake of the drug thanks to reduced costs.

The full report is due to be published in August 2023. Pre-order your copy of the full report here and get 15% off

No Byline Policy

Editorial Guidelines

Corrections Policy

Source